- Automating 90% of manual workflows in small biz loan origination

Casca was brought in to automate manual workflows in small business loan origination by replacing the bank’s legacy LOS with a new system.

- Client

- Community Bank

- Year

- Service

- Commercial Loan Origination

Overview

The bank noticed that their small business loan origination process was requiring a lot of manual work, leading to backlogs and unhappy customers. A key pain point was the manual document collection process, which was taking up to 2 weeks to complete.

Within 3 weeks, Casca replaced the bank’s legacy LOS with a new system that automated 90% of manual workflows:

- loan applications can now be processed end-to-end in 1-4 days

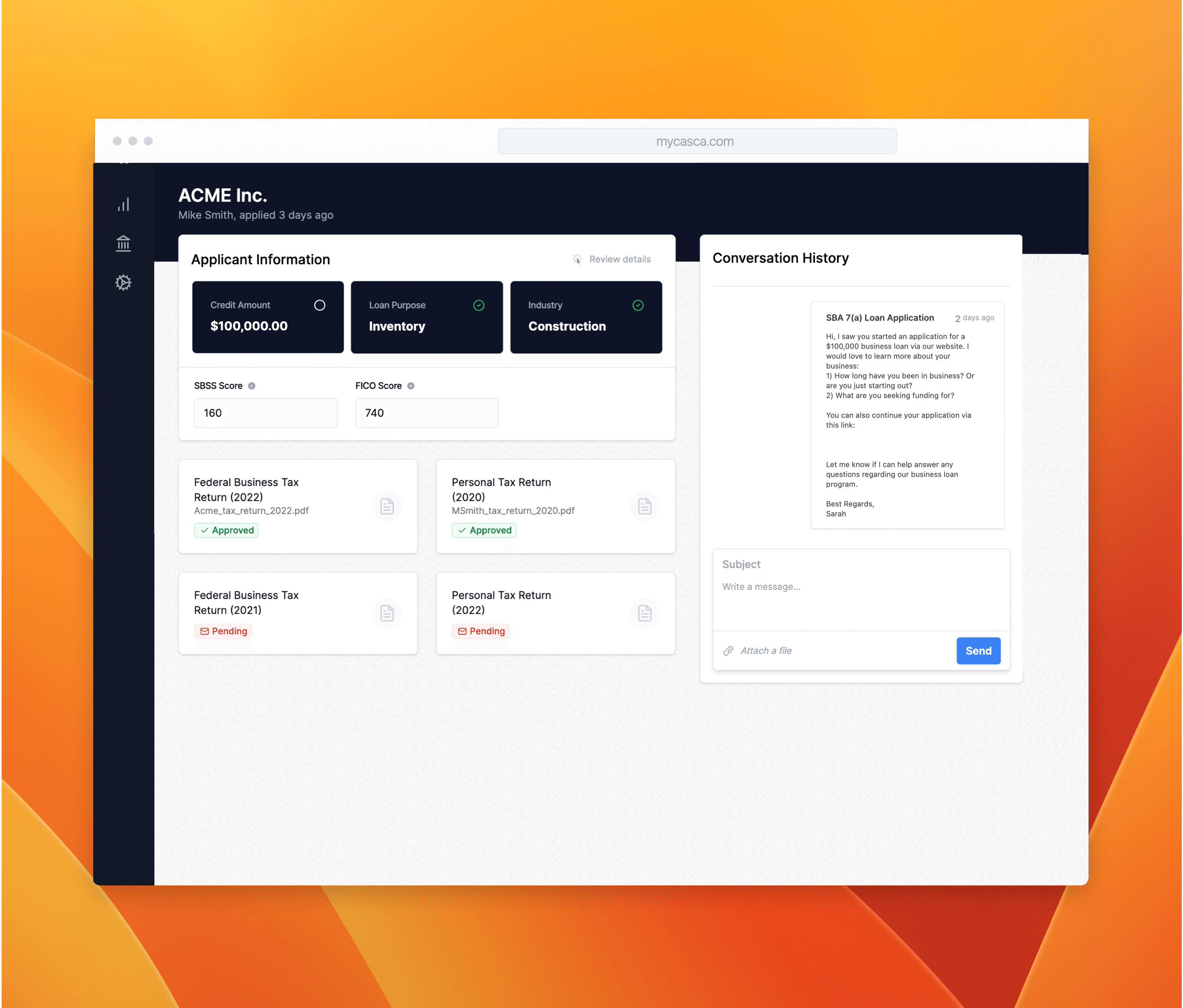

- document collection was fully automated, with personalized reminders and analysis done by the Casca AI Loan Assistant

- the bank’s loan officers now have a single view of all customer data, including documents, financials, and credit scores

Additionally, the bank’s product team can now set up a new loan product and origination process (e.g., SBA 7(a) loans) in 30 minutes, without needing to write any code.

What we delivered

- Casca Loan Origination System

- AI Document Analysis

- Casca AI Loan Assistant

- of manual work automated

- 90%

- End-to-end origination time

- 1-4 days

- to deploy a full LOS

- 3 weeks

- to set up a new loan product

- 30 min